Lifeschooling: 5 Keys for Raising Financially Literate Kids

1. It’s Really About Financial STEWARDSHIP

Raising financially literate kids sits high on my list of objectives as a homeschool mom/teacher. In fact, it comes right after cultivating gospel identity and fluency.

Whether we like it or not, money is the universal language of the tangible world we live in. As well, finances can be the number one stressor in life for many Americans.

I fully believe that being equipped in how to manage that aspect of our lives well (regardless of how much or little we have) is vitally important in being able to live gospel-powered lives, where we can spend more time on focusing on kingdom work over stressing about whether we can pay our bills.

We all know that Jesus talks quite a bit about money in the bible. But, also, it’s not just about money. It’s about the whole idea of stewardship and our hearts with how we manage what God gives us.

And so, raising financially literate kids first begins with fostering hearts of stewardship. Reminding them that money, and all other things in this world for that matter (our homes, our vehicles, our careers, our children, etc.), all belong to God. That everything we “own” is an undeserved gift from our Father. That we need to be open-handed with the life we have and the possessions in it, and to use all of that according to his will (not ours).

We are just stewards of all that passes through our hands.

2. Work Ethic and Perspective

Our kids work and have always been put to work in some capacity around our home. Currently, Big Bro does yard projects and construction-related jobs for both us and others, Big Sis babysits and has worked as a model/actress, and all three have dabbled (still currently dabble) in entrepreneurial ventures.

We’ve always stressed to them the importance of humility and gratefulness for even the opportunity to work or to be able to sell their items in a marketplace. That even the opportunity alone is a gift God has blessed them with; one that not many in the world (especially outside of our first-world context) get.

We’ve also consistently reminded them that as they work, they should work like they are working for the Lord (because they are). That they aren’t just working to earn money, but working to give God (who has given them the arms and legs to be able to work in the first place) glory and praise, in the spaces they get to be in, because of these opportunities.

And we’ve taught them that while any income is important for supporting our basic needs required to live in this world, we should also manage our income in such a way to be able to bless others as well! Again, dollars and cents are what make this world go ’round, and so being able to earn it is important in being able to contribute to practical kingdom work.

With this kind of perspective, our kids are learning to respect both the process and the money they make. They understand the gift and value of work, and try to put their best effort (not always at home, but definitely with others, LOL). And because of this, they don’t just turn around and squander all that they earned with that best effort away!

Creating Earning Opportunities for Your Kids

Now, not all of your kids may work because they are still little. How are they going to practice managing money if they have none?!

We aren’t a family that gives an allowance for chores (we believe that chores – aka maintaining the home – is part of being in a family), but we would create earning opportunities within our home for our kids, that were beyond the scope of keeping their rooms clean, helping clean up from meals, picking up their belongings throughout the house, etc.

For example: We began to pay each of our kids to do their own laundry (load the washer, transfer clothes to the dryer, then put their clean clothes away) when they reached about 6 years old. We don’t pay them now because we personally feel that as tweens/teens growing into adulthood, doing laundry is life skill they need to have, and is part of a regular home maintenance rhythm. But when they were little, this served as a real and consistent opportunity to learn to work for money (so that they could also begin learn how to manage it as well).

Another example: We had a huge walnut tree that dumped its leaves every fall and so we would pay them per bag of leaves raked (and it helped free up time for hubs to do the regular yard maintenance). Seasonal jobs also provide opportunities to work around the house outside of normal chores that simply should be done for being part of the family.

And yet another example: For the most part, our family normally donates clothes/toys/books that our kids no longer use. But there have been specific times where we’ve taking these items and listed them for sale (Craigslist, FB Marketplace, etc.). I’ve taught my kids how to take photos of the items and create the listings. This is another great way for your kids to learn how to bring in an income, as well as cultivate an enterprising spirit. Speaking of enterprising spirit – our kids have also set up lemonade stands, ran yard sales, participated in kid markets, and (more recently) have even tried selling ice cold water and treats at the park, LOL. If there’s a will, there is a way!

3. Allocating Money: Give Your Money Jobs

With a kingdom perspective about money, it will be easier to encourage your kids to allocate what they make into these categories. In fact, these three categories will be your child’s initial experience with a budget aka giving money specific jobs.

Each family has their own way of splitting up the categories into percentages but it typically goes as follows:

- Give: 10%

- Save: 20%-30%

- Spend: 70%-60%

Give

Raising financially literate kids also means raising grateful kids – grateful for getting to even be a part of God’s Big Story and don’t see giving as a chore but as a privilege.

This money is set aside to put back into God’s kingdom – whether that is to church, to do extra things throughout the year for the children our family sponsors, buying items for Operation Christmas Child boxes, spontaneously blessing a friend, etc.

Save

Our kids have mostly used these funds to make big purchases that take longer to save for (think iPad or hoverboard).

Or unforeseen emergencies! Recently, Big Bro had dropped his phone and the entire screen cracked. This was the first time he had experienced an unforeseen emergency (especially for a teenager, LOL), but was able to replace his phone on his own quickly because of consistently putting away dollars for such a time as this. This incident prompted a huge praise to us as parents for training him up in this kind of discipline, as he considered the predicament he would have been in if he didn’t have the funds.

Spend

This is money they use for purchasing their own clothes, shoes, accessories, toys, paid apps, Fortnite V-bucks, treats that are not part of our family’s grocery budget, etc.

This post contains affiliate links and we may earn compensation when you click on the links, at no additional cost to you.

When our kids were younger, we used something called Moon Jars. Now they just use plain paper envelopes.

The Give/Save/Spend system is great for younger ages. When your kids are teens and have more defined expenses, like the cost of going out with friends, taking ownership some of their expenses (like clothing), paying for their portion of the cell phone bill, etc., then you can help them graduate to a more complex budgeting system.

4. Make Spending Hurt

- In the younger (pre-teen years):

When our kids were really young (starting around 5-6 years old), as much as possible, we made them pay in a separate transaction with cash for any impulse purchases like candy or a small toy at the checkout line (gotta love those strategically placed kid temptations when you are waiting for your turn to pay for groceries!). Even if it was our own money (because they didn’t really have much of their own money at that age!), we gave them the actual dollars to hand over to the checkout person. By doing so, they were able to tangibly experience the immediate loss of the money given to them when they exchanged that cash for their toy. Granted, these exchanges didn’t conjure up deep thoughts about financial stewardship, but it at least exercised an awareness, at a really young age, that things do not come for free.

As they grew older (around 7- to 9-ish years old), they began to understand the pain a little more. By this point, they had enough of their own money either from gifts or from earning income for beyond-chore tasks around our home.

They were also pretty proficient at the checkout line (even if payment meant lots and lots of pennies, LOL). It doesn’t matter if your kids have money saved for a purchase … there is still a kind of pain of going through the act of removing their dollars and cents from their wallets to hand over to someone else! (BTW – this is a great way for homeschoolers to “do math” in real life).

- In the tween/teen years:

Give over control of the money you normally spend on your kids, to your kids!

I first learned of the idea through Rachel Cruze’s book with her dad, Dave Ramsey, called: Smart Money Smart Kids: Raising the Next Generation to Win with Money (I highly, highly, HIGHLY recommend this resource). Cruze/Ramsey suggest transferring the amount you normally would spend on your child in a month into a separate checking account, once your child becomes a teenager. This gives them the opportunity to manage their own spending (and also helps drive home further the reality that things have a cost and money is finite).

And in the book Entitlement Trap: How to Rescue Your Child with a New Family System of Choosing, Earning, and Ownership, authors Richard and Linda Eyre outline in more detail something called the “home-based family economy”. This is similar to Ramsey/Cruze’s suggestion of handing over control of expenditures to your child, but the aspect of giving your child opportunities to earn an income is an integral part of this system. This is not a faith-based book, but still has great practical wisdom.

Both ideas would basically require you to tally up what you normally spend on your child each month. Food, clothes, entertainment, lunch money, costs of extracurricular activities, etc. – things you already spend each month on your child. And then hand over to them to manage themselves (with your help and with grace, of course)!

- Why?

Sounds scary, I know. Have your CHILD decide where his/her money goes?! Yup. Concerns are more thoroughly addressed in the books, but the bottom line is that giving your children the opportunity to learn how to manage money (and fail) while under your roof is better than when they are out on their own!

The whole objective of letting our kids take control of their expenses is to give them opportunity to exercise their muscle in “feeling” the real cost of living in the context they are living in; that every little single thing actually does add up and that money is a limited resource that needs to be consistently earned and stewarded well.

We have implemented our own version of a “family economy” in our own home, and let me tell ya – it has been GOLD. In fact, our kids have shared their appreciation for our family’s economic system and how they feel like finances will be one less thing that have to worry about when they finally launch.

- An important thing to note:

We are not super strict about this. Just as God is a good father who gives us good gifts – we will often step in and cover some of their expenses. For example, if they have been contemplating a purchase they really want, but are wrestling with whether to part with the cash or not, we will bless them with that item (to us it is a victory that they are even demonstrating thoughtfulness about how to spend). The main point is to help grow their muscles in financially literacy and stewardship, not treat them like soldiers at a financial bootcamp!

5. Prioritize Financial Education in Your Home

Most kids grow up being trained to focus on getting good grades in school, so that they can go to college, and therefore have better opportunities when they get older. Often, academics (and even extra-curriculars!) trump real life skills like financial literacy.

But if finances are one of (if not THE greatest) stressors for Americans, then we clearly need to emphasize the importance of a financial education – way before they are adults, and certainly way before they are juggling work with family and making sure bills are paid.

Teach your kids how to make and live by a budget (and about cultivating a content heart!). Discuss how debt works and what happens when you accumulate it. Emphasize the importance of saving and investing – and the difference between both.

But What if I Haven’t Been Great at My Own Finances?!

Now I get that this may not be an easy thing to do, especially if you are struggling in your own finances and feel ill-equipped to teach your kids. My husband and I were there once! Which is why we are now so passionate of helping our own kids avoid the mistakes we did.

Start small. Take one step at a time. If you don’t have a budget, create one. If your kids are old enough to understand, be transparent with them about the fact you may not necessarily have been the greatest steward of God’s money and possessions, and that you want to change that; what a gift to your kids when you can be vulnerable in such a way! No one is perfect, even in their finances, but what’s important is acknowledging that weakness and asking God to put you back on track (and your kids seeing you do this).

Don’t forget – our God is a God of redemption, and he can certainly redeem your financial situation if you can surrender it to him!

Start with Yourself: Resources for Parents (Any Adult, Really)

Crown Financial Ministries‘ website is a great place to start. When we were young parents (our oldest was barely 2, and I was pregnant with our second), we took our first biblical finance course through Crown (it was offered by one of the local churches in our town). Absolute game-changer for us. We also have the book: Your Money Counts: The Biblical Guide to Earning, Spending, Saving, Investing, Giving, and Getting Out of Debt, written by one of Crown’s co-founders, Howard Dayton. This was the first book our son read on his own about the subject.

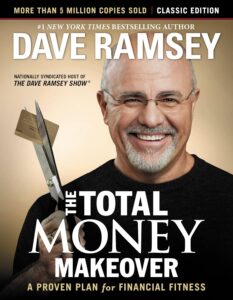

And almost all of us (in the Christian world) know about (or at least have heard of) Dave Ramsey! We also took his Financial Peace University course and learned about “zero-based budgeting” and the “debt snowball“. His book, The Total Money Makeover: A Proven Plan for Financial Fitness, offers life-transforming financial wisdom, if you apply it.

There are obviously so many more resources out there on the subject of finances. Just make sure that the wisdom you are receiving comes from a biblical world view!

Financially Literacy Isn’t Financial Perfection

This isn’t about raising kids who will always make wise purchases, or who never exceed their budgets, or who won’t ever fail at giving consistently with a kind and generous heart, or will end up being philanthropic millionaires.

Raising financially literate kids simply means that they understand their stewardship role over the resources that God allows them to manage. It means fostering open-handed hearts and lives. It means being equipped with the knowledge and wisdom to be able to do their role of financial steward as best they can, so that with their money (how they use it), they can point others to the Giver of it all.

NEED PRACTICAL TOOLS/RESOURCES FOR RAISING FINANCIALLY LITERATE KIDS? CHECK OUT THIS COMPANION POST!